LIFE AND AD&D INSURANCE

Centurion provides basic life and AD&D insurance to all benefits-eligible employees AT NO COST. You have the option to purchase supplemental life and AD&D insurance.

Depending on your personal situation, basic life and AD&D insurance might not be enough coverage for your needs. To protect those who depend on you for financial security, you may want to purchase supplemental coverage. Use the calculator here to find the right amount for you.

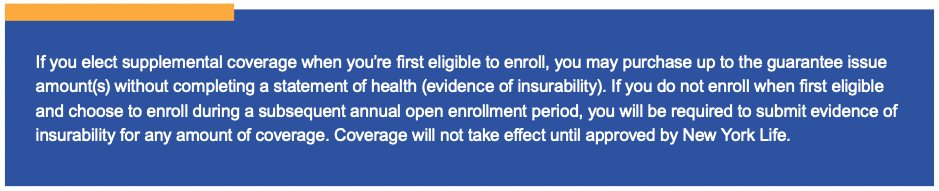

SUPPLEMENTAL LIFE INSURANCE

Centurion provides you the option to purchase supplemental life insurance for yourself, your spouse, and your dependent children through New York Life.

You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. Supplemental life rates are age-banded. Benefits will reduce to 65% at age 65, 45% at age 70, 30% at age 75, and 20% at age 80.

- Employee: $10,000 increments up to $1,250,000 or 4x annual salary, whichever is less— guarantee issue: 4x annual earnings up to $200,000

- Spouse: $5,000 increments up to 100% of the employee’s election or $250,000, whichever is less— guarantee issue: $25,000

- Dependent children: Live birth to 6 months: $500; 6+ months: $10,000—guarantee issue: $10,000

VOLUNTARY LONG-TERM DISABILITY INSURANCE

Centurion provides the option to purchase voluntary long-term disability (LTD) insurance through New York Life to all benefit-eligible employees after six months of continuous employment. LTD insurance is designed to help you meet your financial needs if your disability extends beyond the STD period.

- Benefit: 60% of base monthly pay up to $6,000 per month

- Elimination period: 90 days

- Benefit duration: Two years own occupation than any occupation to age 65

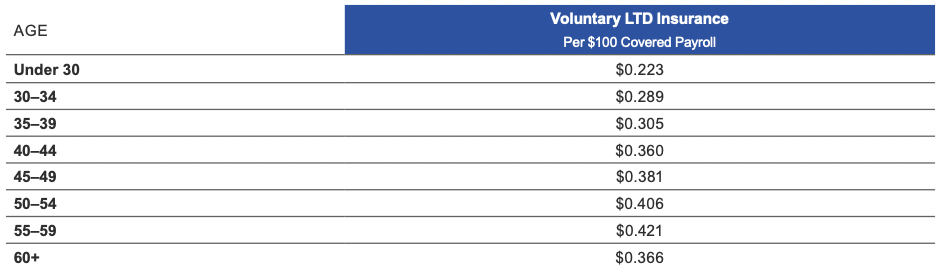

Voluntary LTD Insurance Costs

Listed below are the per-pay-period (26 pay periods per year) deductions (costs) for voluntary LTD insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

VOLUNTARY CRITICAL ILLNESS

Critical illness insurance provides a financial, lump-sum benefit upon diagnosis of a covered illness. These covered illnesses are typically very severe and likely to render the affected person incapable of working. Because of the financial strain these illnesses can place on individuals and families, critical illness insurance is designed to help you pay your mortgage, seek experimental treatment, or handle unexpected medical expenses.

- Employee: $5,000, $10,000, $20,000 or $30,000—guarantee issue: $30,000

- Spouse: 100% of employee’s election—guarantee issue: 100% of employee’s election

- Dependent children: Up to age 26: 50% of employee’s election—guarantee issue: 50% of employee’s election ⸰ Health screening benefit: $100

VOLUNTARY ACCIDENT INSURANCE

Accident insurance helps protect against the financial burden that accident-related costs can create. This means that you will have added financial resources to help with expenses incurred due to an injury, to help with ongoing living expenses, or to help with any purpose you choose. Claims payments are made in flat amounts based on services incurred during an accident.

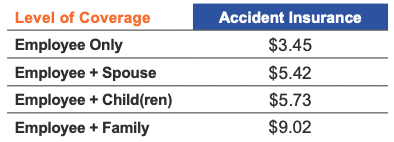

ACCIDENT INSURANCE COSTS

Listed to the right are the per-pay-period (26 pay periods per year) deductions (costs) for accident insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

HOSPITAL INDEMNITY INSURANCE

Hospital indemnity insurance will pay benefits that help you with costs associated with a hospital visit such as a covered accident, illness, or childbirth. This benefit pays you a lump-sum upon admittance so that you can choose how best to cover your expenses. You also receive a $50 wellness benefit every year when you complete a health screening.

Hospital admission: Low plan $1,000 per admission; High plan $1,500 per admission

Daily hospital confinement: Low plan $100 per day*; High plan $150 per day*

Hospital intensive care unit confinement: Low plan $200 per day*; High plan $300 per day*

*Up to 30 days per calendar year

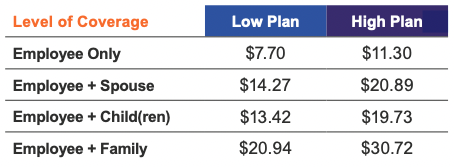

HOSPITAL INDEMNITY COSTS

Listed to the right are the per-pay-period (26 pay periods per year) deductions (costs) for hospital indemnity insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

VOLUNTARY PET INSURANCE

Centurion provides you the option to purchase voluntary pet insurance through Nationwide. You have two plan options to choose from: My Pet Protection and My Pet Protection with Wellness. My Pet Protection includes accidents, illnesses, and surgeries, while My Pet Protection with Wellness includes wellness exams, vaccinations, dental cleanings, and more. You can purchase a plan that best suits your budget.

For pricing and additional information, contact Nationwide at 888-899-4874 or petinsurance.com/centurion. Note: Pre-existing conditions are not covered.