BUDGETING FOR YOUR CARE

Centurion offers two types of pre-tax accounts: a health savings account (HSA) and flexible spending accounts (FSAs).

When you put money into a pre-tax account, you can save up to 20%* on your care and increase your take-home pay because you don’t pay tax on your contributions.

*Percentage varies based on your tax bracket.

HEALTH SAVINGS ACCOUNT

If you enroll in the KeyCare HDHP, you may be eligible to open and fund a health savings account (HSA) through WealthCare.

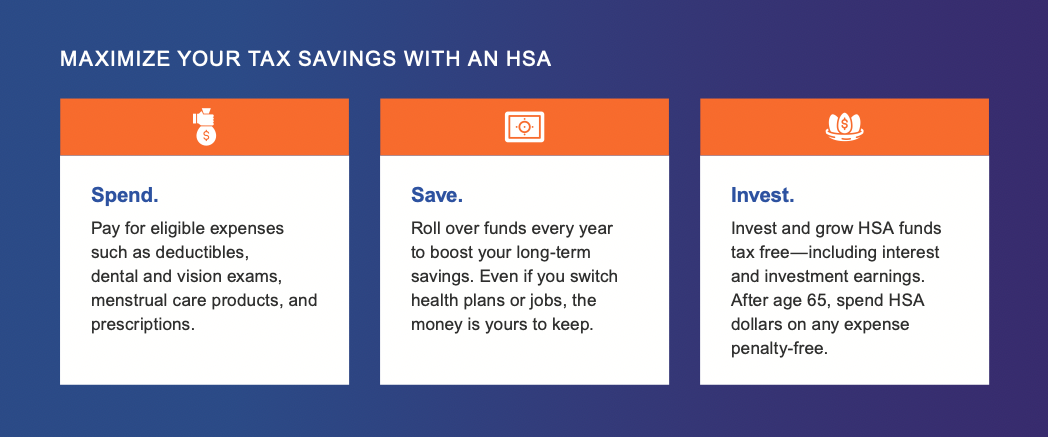

An HSA is a savings account that you can use to pay out-of-pocket health care expenses with pre-tax dollars.

CENTURION CONTRIBUTION

If you enroll in the KeyCare HDHP, Centurion will help you save by contributing to your account.

- Employee-only: $1,000

- All other coverage levels: $2,000

2024 IRS HSA CONTRIBUTION MAXIMUMS

Contributions to an HSA (including the Centurion contribution) cannot exceed the IRS allowed annual maximums.

- Individuals: $4,150

- All other coverage levels: $8,300

If you are age 55+ by December 31, 2024, you may contribute an additional $1,000.

HSA ELIGIBILITY

You are eligible to fund an HSA if:

- You are enrolled in the KeyCare HDHP.

You are NOT eligible to fund an HSA if:

- You are covered by a non-HSA eligible medical plan, health care FSA, or health reimbursement arrangement.

- You are eligible to be claimed as a dependent on someone else’s tax return.

- You are enrolled in Medicare, TRICARE, or TRICARE for Life.

Refer to IRS Publication 969 for additional eligibility details. If you are over age 65, please contact Human Resources.

FLEXIBLE SPENDING ACCOUNTS

Centurion offers three flexible spending account (FSA) options through TRI-AD.

HEALTH CARE FSA (NOT ALLOWED IF YOU FUND AN HSA)

Pay for eligible out-of-pocket medical, dental, and vision expenses with pre-tax dollars.

The health care FSA maximum contribution is $3,200 for the 2024 calendar year.

LIMITED PURPOSE HEALTH CARE FSA (IF YOU FUND AN HSA)

If you fund an HSA, you can also fund a limited purpose health care FSA. The limited purpose health care FSA can only be used for dental and vision expenses.

The limited purpose health care FSA maximum contribution is $3,200 for the 2024 calendar year.

DEPENDENT CARE FSA

The dependent care FSA allows you to pay for eligible dependent day care expenses with pre-tax dollars. Eligible dependents are children under 13 years of age or a spouse, a child over 13, or elderly parent residing in your home who is physically or mentally unable to care for him or herself.

You may contribute up to $5,000 to the dependent care FSA for the 2023 plan year if you are married and file a joint return or if you file a single or head of household return. If you are married and file separate returns, you can each elect $2,500 for the 2023 plan year. (Amount subject to change. 2024 maximums not released at the time of publication.)

COMMUTER BENEFITS

Centurion allows you to pay up to $280 per month for commuter transit costs and $280 per month for commute-related parking costs with tax-free dollars through TRI-AD.

PUBLIC TRANSPORTATION AND VANPOOLS

- Commuter check vouchers: Commuter checks can be used to purchase transit passes, tickets, fare cards, or other fare media for the transit authority of your choice. They can also be used to pay for vanpool expenses. Commuter checks come in flexible denominations to meet your transit needs and are valid for 15 months.

- Commuter check card: This card is accepted at transit agencies or designated transit retail centers where only transit and vanpool passes, tickets, and fare cards are sold.* The card can be also used at fare vending machines. This saves you time waiting in line and time locating a customer service desk or staffed sales area.

- Fare media: Various transit passes, tickets, and fare cards are offered by participating transit authorities (tolls are not eligible) across the nation. They are sent directly to your home, so you avoid waiting in line to purchase your transit passes.

*For compliance reasons, the commuter check card can only be accepted at designated outlets that sell transit products exclusively, such as transit stations and kiosks. Stores that sell other products, such as station sundry shops, will not accept the commuter check card.

PARKING

- Monthly direct pay: This solution allows TRI-AD to send payments directly to your parking provider each month, so you don’t have to worry about writing checks and mailing payments.

- Commuter check for parking vouchers: These vouchers are made payable to the parking provider of your choice and can be used to pay for parking expenses. Commuter check for parking vouchers may be used to purchase one or more types of parking, and you can order as many vouchers as needed for multiple parking providers. They come in flexible denominations and are valid for 15 months.

- Commuter check card: This prepaid card offers the functionality and convenience of a reloadable, personalized debit card for use at parking facilities nationwide. No receipts are necessary with this solution—just swipe and go.

- Parking cash reimbursement: You can elect a monthly amount to be set aside from your paycheck into a pre-tax spending account. Once you have incurred out-of-pocket parking expenses, simply complete a claim form and submit it with receipts for reimbursement.

HOW TO ENROLL

Visit tri-ad.com/commute to enroll in the commuter benefits. You must enroll by the tenth day of the month for your election to be effective on the first day of the following month. For example, enroll by June 10 for your election to be effective July 1.

For more information, visit tri-ad.com/commute or call 888-844-1372 Monday through Friday from 8 a.m. to 9 p.m. EST. Note: These limits are subject to change for 2023 (2023 limits not released at time of production).